alameda county property tax payment

Alameda County Property Tax Lookup. Pay Your Property Tax.

Enter the requested data to start the Alameda property taxes lookup.

. 125 12th Street Suite 320 Oakland CA 94607. You can pay online by credit card or by electronic check from your checking or savings account. Alameda County Ordinance Chapter 304 requires all business activities in the unincorporated areas of the County to obtain a business license each year and to pay a tax by January 1 of each year on the business gross receipts of the preceding fiscal year.

Find Information On Any Alameda County Property. What information is provided on the 24-Hour Property Tax Payment and Information System. Last day to pay first installment of property taxes without penalty.

This generally occurs Sunday morning from 700 to 900 AM and weeknights from 100 to 200 AM. Quiroga Chief Deputy Tax Collector Henry C. So if your home is worth 200000 and your property tax rate is.

Postal Service Postmark is acceptable. 2 How to make the Alameda County Property Tax Payment Online. To estimate your real estate taxes you merely multiply your homes assessed value by the levy.

125 12th Street Suite 320 Oakland CA 94607. Pay Your Property Taxes Online. The following information and services can be accessed with any touch-tone telephone 24-hours a.

Full payment is due April 30th. A tax rate of 010 to 150 depending upon the business category applies to each 1000. The system may be temporarily unavailable due to system maintenance and nightly processing.

This generally occurs Sunday morning from 700 to 900 AM and weeknights from 100 to 200 AM. Use in the conduct of official Alameda County business means using or operating the Parcel Viewer in the performance of or necessary to or in the course of the official duties and services of Alameda County. Levy Treasurer-Tax Collector.

Alameda County Treasurer-Tax Collector. The tax payment should be mailed to. A convenience fee of 25 will be charged for a credit card transaction.

Select the option to start invoice payments. Ad Need Property Records For Properties In Alameda County. Alameda County Treasurer-Tax Collector 1221 Oak Street Room 131 Oakland CA 94612.

Due dates for tax payment. View Alameda County Property Tax Bills. Would it help you to pay in monthly payments.

A message from Henry C. OR half payments are due February 28th and June 15th with no. Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612.

Are you having trouble paying your annual property taxes in two installments. You wont get a receipt if you mail in your taxes so check your bank statement to see that the check has cleared. 1221 Oak Street Room 131.

Bill of Alameda County Property Tax. We accept Visa MasterCard Discover and American Express. Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check s.

Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check System. The Alamosa County Treasurer will assess a 500 administrative fee when payment of any real property tax statement is less than 1000 CRS. You can mail in a check and make it payable to Treasurer-Tax Collector Alameda County.

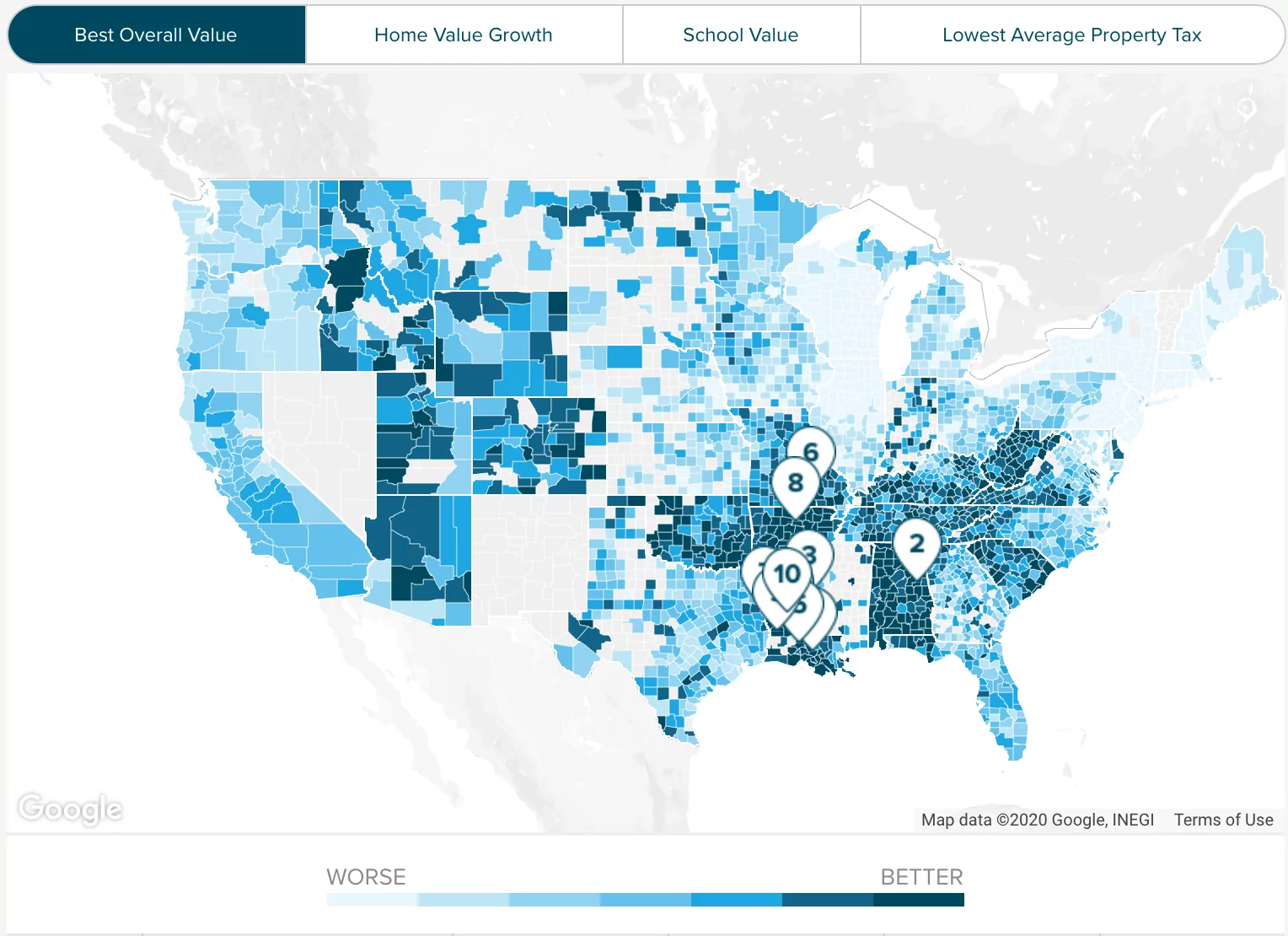

The difference between Alameda Countys E-Check Payment versus Online Banking Payments. You can use the interactive map below to look up property tax data in Alameda County and beyond. A message from Henry C.

A message from Henry C. The mailing address is. Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612.

Alameda County Assessors Office 1221 Oak Street Room 145 Oakland CA 94612. Thacker Assistant Treasurer Elvia O. No fee for an electronic check from your checking or savings account.

Ad Is Your County of Alameda Bill Due Soon Pay Your Bill Securely with doxo. Lookup or pay delinquent prior year taxes for or earlier. Levy the Alameda County Treasurer-Tax Collector regarding the benefits of paying your Property Tax using the Alameda County E-Check System.

Who do I make my check payable to. Alameda County Administration Building 1221 Oak Street Room 131 Oakland California 94612. The difference between Alameda Countys E-Check Payment versus Online Banking Payments.

The system may be temporarily unavailable due to system maintenance and nightly processing. 125 12th Street Suite 320 Oakland CA 94607. Lookup or pay delinquent prior year taxes for or earlier.

Prohibited uses include but are not limited to uses for political campaigns personal matters or profit.

How To Pay Property Tax Using The Alameda County E Check System Youtube

55 Walnut St Winsted Ct 06098 Property Record

Transfer Tax Alameda County California Who Pays What

Alameda County Ca Property Tax Calculator Smartasset

Birmingham Mi Real Estate Birmingham Homes For Sale Realtor Com Living Room Dimensions Dining Room Dimensions Bedroom Dimensions

Beautiful Lakes At Grand Harbor Home In South Katy

Monopoly Man Monopoly Man Music Business Alameda County

Alameda County Ca Property Tax Calculator Smartasset

Search Unsecured Property Taxes

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Lake Garden Celebration Fl

Alameda County Property Tax News Announcements 11 08 21

David Weekly Townhouse Home Owners Association Fees In Spring Lake Celebration Fl Spring Lake Lake Garden Celebration Fl

New Program Allows Taxpayers Pay Annual Property Taxes In Monthly Installments County Of San Luis Obispo